Our Knowledge Base

Hydroprocessing catalyst reload and restart best practices—Part 2

By Shaun Dyke and Nattapong Pongboot (Former Associate)

Global R&D Co., Ltd.

Hydrocarbon Processing

AUGUST 2022

Hydroprocessing (hydrotreating and hydrocracking) units are high-pressure, high-temperature units that have multiple reactors, multiple beds per reactor and specialized metallurgy.

The insights in Part 1 of the article cover, our experts, Shaun Dyke and Nattapong Pongboot, explain how the best performers take a highly structured and disciplined approach to catalyst change-out turnarounds in both the planning and execution phases.

The insights in Part 2 of the article will discuss the activities associated with catalyst loading and the restart, important elements in the broader catalyst reload process, across the full catalyst cycle many of the best practices are used to manage and mitigate the underlying risks for these units.

Hydroprocessing catalyst reload and restart best practices—Part 1

By Shaun Dyke and Nattapong Pongboot (Former Associate)

Global R&D Co., Ltd.

Hydrocarbon Processing

JULY 2022

Hydroprocessing (hydrotreating and hydrocracking) are high margin refining units and the costs associated with time delays that extend a catalyst reload turnaround are extremely high.

Our experts, Shaun Dyke and Nattapong Pongboot, explain how the best performers take a highly structured and disciplined approach to catalyst change-out turnarounds in both the planning and execution phases – managing the complexities and risks associated with a catalyst change-out and restart for refinery hydroprocessing units, as well as hydroprocessing units for renewable fuels. The new article, split into two parts, discusses the activities associated with the entire process, across the full catalyst cycle and many of the best practices that are used to manage and mitigate the underlying risks for these units.

The insights in Part 1 of the article cover the activities associated with turnaround planning, shutdown of the unit, catalyst unloading and reactor inspection.

Hydroprocessing (hydrotreating and hydrocracking) units are high-pressure, high-temperature units that have multiple reactors, multiple beds per reactor and specialized metallurgy. Catalysts in these units are replaced on a 2 yr–5 yr cycle, depending on feed quality, unitdesign, catalyst selection, operational constraints and performance.

Hydroprocessing catalyst selection—Part 2: Considerations and best practices for catalyst testing

By Nattapong Pongboot (Former Associate)

Global R&D Co., Ltd.

Hydrocarbon Processing

JUNE 2022

Hydroprocessing catalysts are an essential part of the refinery involved in the treatment/conversion of most petroleum fractions, ranging from naphtha to residue.

Hydrotreating catalysts help refiners meet fuel regulations and enhance the performance of downstream catalysts and processes, [e.g., naphtha reforming or fluid catalytic cracking (FCC)] by removing sulfur (S), nitrogen (N) and metals from their feedstocks, as well as improving product properties by hydrogen (H) addition. Moreover, hydrocracking catalysts further improve refiners’ profits by converting low-value streams [e.g., vacuum gasoil (VGO)] into high-value fuels and chemical feedstocks.

Therefore, the selection of hydroprocessing catalysts requires great care from refiners to ensure maximum asset utilization and profitability.

Hydroprocessing catalyst selection—Part 1:

Planning and selecting the catalyst evaluation method

By Nattapong Pongboot (Former Associate)

Global R&D Co., Ltd.

Hydrocarbon Processing

MAY 2022

Part 1 of this article discusses pitfalls in planning and selecting the catalyst evaluation method and provides best practices to guide refiners towards an optimal hydroprocessing catalyst selection.

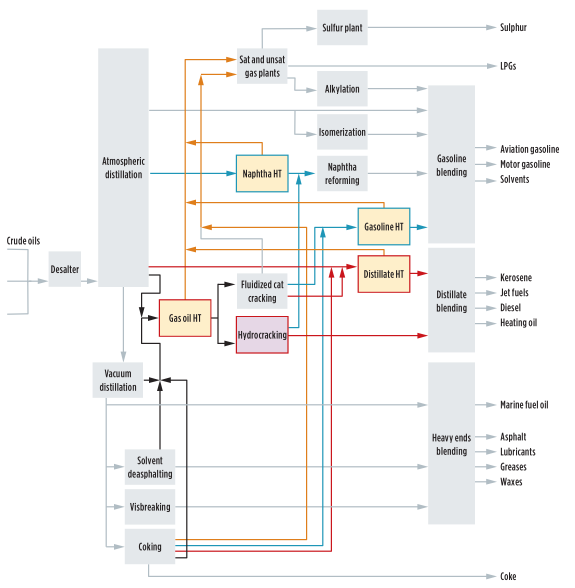

Hydroprocessing catalysts are an essential part of any refinery involved in the treatment/conversion of most petroleum fractions ranging from naphtha to residue (FIG. 1). Hydrotreating catalysts help refiners meet fuel regulations and enhance the performance of downstream catalysts and processes [e.g., naphtha reforming or fluid catalytic cracking (FCC)] by removing sulfur, nitrogen and metals from their feed-stocks as well as improving product properties by hydrogen addition. Moreover, hydrocracking catalysts further improve refiners’ profits by converting low-value streams [e.g., vacuum gasoil (VGO)] into high-value fuels and chemical feedstocks.

Therefore, selecting hydroprocessing catalysts requires great care to ensure maximum asset utilization and profitability.

Hydroprocessing catalyst selection – Part 1

Unlocking Hydraulic Limits in a Revamp

By Nattapong Pongboot (Former Associate)

Global R&D Co., Ltd.

CHEMICAL ENGINEERING WWW.CHEMENGONLINE.COM

DECEMBER 2021

Follow the practical tips discussed here to accelerate hydraulic revamp projects and increase the success rate

Conducting a thorough hydraulic check is a crucial part of a successful plant revamp. Depending on the remaining margin of the hydraulic system, a certain degree of modifications may be required to accommodate a new unit throughput configurations. Conventional hydraulic calculations can be time-consuming, involving engineering documents, possibly with expensive hydraulic calculation software. This article provides helpful tips to significantly reduce the person-hours required for hydraulic review. Also, unorthodox, yet practical, methods for equipment sizing will be demonstrated as fast-track solutions to unlock hydraulic constraints at a chemical process industries (CPI) facility. These tips and methods come out of the author’s experience as a plant operator and designer, and are illustrated with several real-world examples.

Unlocking Hydraulic Limits in a Revamp_ChE_Dec2021

Backwash Tuning for Reliable Sand Filtration

By Nattapong Pongboot (Former Associate) and Wiroon Tanthapanichakoon

Global R&D Co., Ltd.

Wirinya Karunkeyoon and Kanyaporn Lertwimolkasem

PTT Global Chemical, Thailand

CHEMICAL ENGINEERING WWW.CHEMENGONLINE.COM

SEPTEMBER 2021

This practical guide provides information on proven backwash-tuning techniques that will improve the reliability and robustness of sand filters in water treatment applications

Water is a fundamental part of virtually all plants in the chemical

process industries (CPI).

Examples of water usage include the following: makeup water for an open, recirculating cooling-water system; boiler feedwater for steam production; firewater; and others. Raw water must be treated or clarified before being used as makeup water in most utility processes. Clarification and filtration remove suspended and partially dissolved solids, bacteria and other forms of impurities to help prevent system scale, corrosion, and fouling.

Backwash Tuning for Reliable Sand Filtration_ChE_Sep2021

Thailand’s Petrochemical Industry

By Wiroon Tanthapanichakoon

Global R&D Co., Ltd.

American Institute of Chemical Engineers (AIChE)

www.aiche.org/cep

MAY 2019

Thailand has one of the most well-developed petrochemical industries in Asia. This article provides insights into past and present trends, challenges, and key success factors for the Thai chemical industry.

Thailand has a significant economic presence in Asia, with a gross domestic product (GDP) ranking in the region’s top ten. The country’s petrochemical industry, which accounts for about 5% of its GDP, has a long history of growth and development (1). This article offers insights into Thailand’s economic background, discusses the trends, policies, and challenges that impact the Thai chemical industry, and includes perspectives from industry executives and experts on its future prospects.

Thailand’s economy

With an estimated population of 69 million (2), Thailand has the second-largest economy in southeast Asia, behind Indonesia. Its GDP per capita of US$5,900 (3) places the country fourth in the region, behind Singapore, Brunei, and Malaysia.

Relatively large domestic demand has enabled the petrochemical sector to capitalize on economies of scale. Thailand’s largest chemical and petrochemical complex is located about 200 km east of Bangkok in Map Ta Phut (MTP), in the Rayong province. It is one of the largest and best developed petrochemical complexes in Asia (Figure 1).

After the 1973 and 1979 oil shocks, the Thai government decided to develop its domestic natural gas and petrochemical industries to reduce energy imports as well as the impact of global crude oil price fluctuations on Thai petrochemical product prices. The discovery of wet natural gas reserves in the Gulf of Thailand was another key driver for industry development. This gas contains sufficient C2+ molecules (ethane, propane, and butane) to be useful for both the petrochemical and fuel industries. In 1978, the Thai government founded the Petroleum Authority of Thailand (PTT) to advance the country’s natural gas and petrochemical industries.

Commercial natural gas production and underwater pipeline transportation from the Gulf of Thailand began in 1981. Thailand’s first proposed petrochemical complex, the National Petrochemical Complex Project-1(NPC-I), relied on wet gas for C2- feedstocks. Since that time, the gas-based petrochemical industry has contributed significantly to the Thai economy (4).

03-4 CEP-20190572 Global Outlook – Thailand's Petrochemical Industry (final)

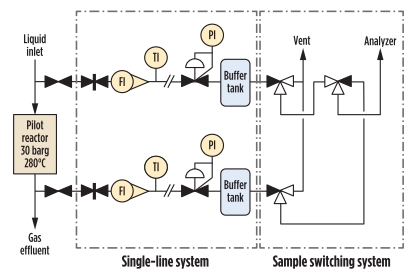

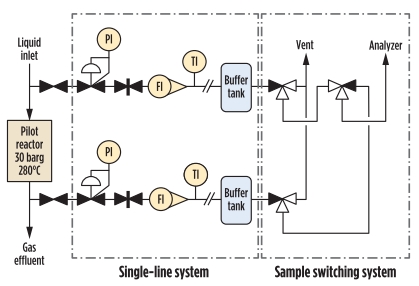

Solve online analyzer time delays by improving sampling system design

By Wiroon Tanthapanichakoon and K.Suriye

Process Engineering and Optimization

JANUARY 2016

Process design engineers may occasionally become involved in the design of online analyzers and their associated sampling systems. Here are proven and practical strategies to significantly reduce time delays without added or expensive investment. Time delay is key in sampling loop design: to use analyzer data to adjust process control, it should reflect the most recent process conditions. Specialist analyzer engineers are good at specifying components in analyzer systems based on experience with previous analyzer systems. However, if they have limited process engineering fundamental knowledge, analyzer sampling loop design is often copied “as is” from prior designs without understanding that a seemingly reasonable design may cause significant time delays. Too often, the time delay is not calculated, but is blindly assumed as acceptable by the process engineers who design the main process system, causing unexpected process control problems in service.

WHAT ENGINEERING STANDARDS DO AND DO NOT TELL YOU??

HP Watermarked Final Version-Solve Anayzer Time Delays (Final)

Unlocking the Secrets of Plate-and-Frame Heat Exchangers

By Grittaya Srinaphasawadi and Wiroon Tanthapanichakoon

CHEMICAL ENGINEERING WWW.CHEMENGONLINE.COM

MAY 2014

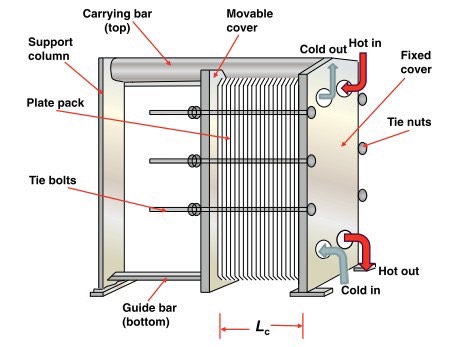

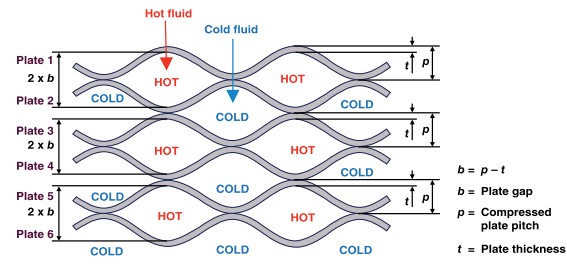

An understanding of the design, sizing, specification and installation of plate-and-frame heat exchangers is necessary to evaluate vendors’ proposed designs

Plate-and-frame heat exchangers, or plate heat exchangers (PHEs), are a type of compact heat exchanger. PHEs have been widely used in the food industries, mainly because they easily meet health and sanitation requirements due to their simple disassembly for cleaning. They have recently become more common in the chemical process industries (CPI) for certain applications and operational conditions. Generally, a PHE is designed and supplied by vendors exclusively, making them a proverbial “black box” for engineers. However, it is a poor practice to rely only on vendors, who, at times, may not fully understand actual fluid properties or process requirements at a specific site.

This can lead to design mistakes or equipment inadequacies. This article covers the practical design aspects of PHEs, and explains how to design a PHE using a generally accepted method derived from heat-exchanger design fundamentals. This method can be applied to the preliminary design of a PHE and can also be used to review vendors’ proposed equipment for its suitability for a required service.

What engineers should know

0514_MPB_4-83-PHE-Article_Final-16-Apr-2014

PHE Article_Final (16 Apr 2014)”]

Accelerating Process and

Product Development

By Wiroon Tanthapanichakoon

CHEMICAL ENGINEERING WWW.CHEMENGONLINE.COM

February 2013

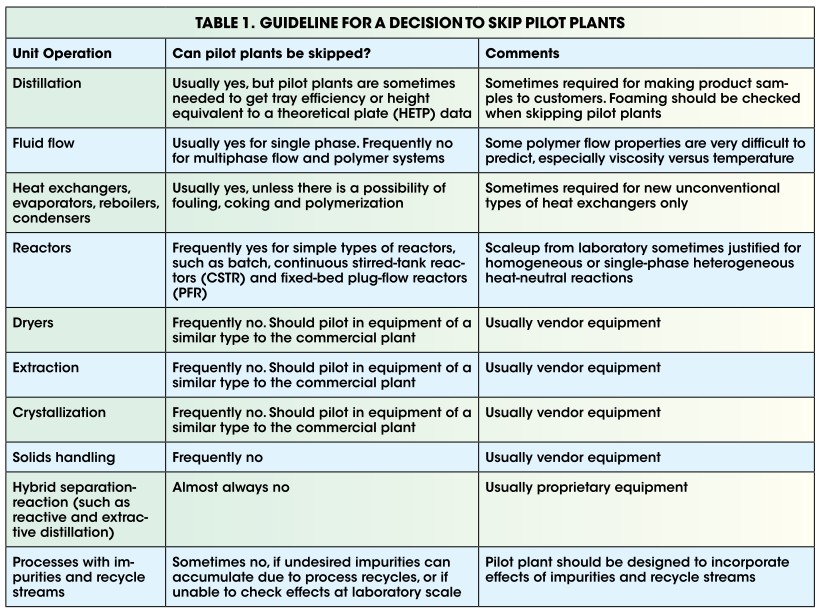

These simple strategies can be used to speed up and increase the success rates of R&D projects

Research and development (R&D)

projects usually require significant time, effort and manpower to become successful. Despite the significant resources spent on R&D projects, only 5–10% of the projects are statistically believed to be successfully commercialized, in terms of both timing and technological advances. Many projects fail because they cannot achieve the desired results on timing of commercialization

and licensing.

This article is focused on providing systematic strategies to speed up both technical and non-technical aspects of R&D projects — especially new process development. It addresses certain aspects that have not been mentioned in previous technical references [1–5], such as basing R&D project management on manpower resource characteristics. It also presents strategies to speed up process development projects visually in a diagram (Figure 1) that is easy to follow and use.

Overview

Types of R&D projects Research and Development projects can generally be classified into the four types listed below [1]:

• Basic research

• New application research

• New product development — In this article, new products are limited to those that are an intrinsic part of new process development, such as new catalysts and solvents

• New process development — As mentioned above, this can sometimes incorporate new products, such as catalysts and solvents. New process development is the focus of this article

0213_EP_DL_1-161-Accelerating-Process-and-Product-Development-ChE-Magazine_Final

Accelerating Process and Product Development (ChE Magazine_Final)”]